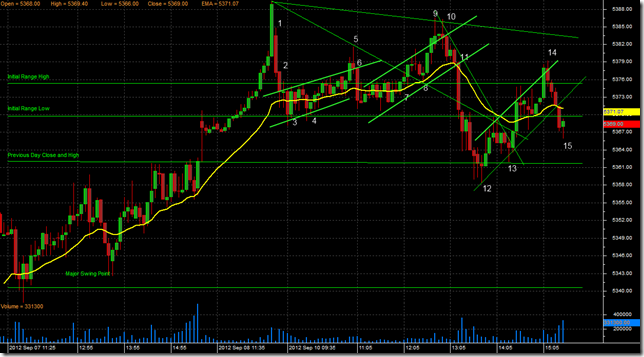

Nifty opened near Saturday’s close due to lack of Global and domestic cues. Nifty Future on open displayed bearish strength that moved it till Saturdays opening price. I have given below the 5-min candle stick chart with my observations about the crucial candle stick bars that would give an insight into today’s price action and trade opportunities.

I have described the significance of the candle stick bars below.

Bar 1: Strong Bear Reversal Signal bar with high volume that has a small tail at the bottom

Bar 2: Bear Reversal Entry bar with open at the close of the previous bar

Bar 3: Bull twin Reversal bar with a small tail at the top

Bar 4: Double bottom Bull Reversal bar with small body and a shaved head

Bar 5: Bear Reversal Bar with a 2 tick tail at the bottom that reverses below the close of the Bar 1. This is an overshoot of the trend channel line. i.e. line drawn on the highs of prior bars

Bar 6: Big Bear Entry Bar which closes below the close of the prior 10 bars. This is a sign of bearishness.

Bar 7: Small Doji bar that breaks out of the Initial Range High and touches the downward trend line

Bar 8: Doji Bar with bullish body that test the Initial Range High, 21EMA, downward trend line.

Bar 9: Break out failure of the Day’s high. This is an overshoot of the trend channel line not given in chart.

Bar 10: Double top and breakout failure of the day’s high. This is an overshoot of the trend channel line not given in chart.

Bar 11: Big Bear Entry Bar which closes below the close of the prior 20 bars. This is a sign of bearishness.

Bar 12: Bars forming a horizontal range instead of a pullback at the Friday’s Closing Price and Saturday’s low price.

Bar 13: Reversal Bar which test the price extreme

Bar 14: Break out failure of the Initial Range High and strong Bear Reversal Bar. This is an overshoot of the trend channel line not given in chart.

Bar 15: Break out failure of the Initial range low

Summary:

The day began with strong bearish bar (Bar 1) with high volumes and a trend continuation bar (Bar 2). Nifty Future formed a double bottom break out failure at 5370. Nifty Future initial moderate volume attempts to reverse with the double bottom is met with a break out failure (Bar 5). Nifty Future spikes down with a Bear trend bar (Bar 6) that closes below the previous 10 bars. A sign of bearishness. The tight trading range that Nifty Future was trapped in till 11:00am did not stop the opening session bearishness.

Nifty Future does not attempt to break the days low but breaks the Initial Range high with a small doji bar (Bar 7). This indicates a weak break out. The break out test the prior high of 5382 and makes a double top and then test the Initial Range High (Bar 8).

Bar 8 is an long entry trade with stop loss below Initial Range High, 21EMA, downward trend line. The target is the break of the 5382 level. This trade though successful was a scalp trade.

Nifty Future has breakout failure at the Day’s high of 5385 and a double top (Bar 9, Bar 10) with the second breakout failure having a strong Bear trend entry bar.

The break on the Initial Range High with the strong and big bear trend entry bar (Bar 11) is a short entry trade with stop loss at the prior high of 5382 and target is the break of the days low @ 5370 and touch of the Previous days low @ 5360.

Nifty future forms a horizontal range at the Previous days low which signals a start of the 2 leg pullback to the 21EMA. Nifty Future moves till the Initial Range low and the 21EMA and the downward sloping trend line.

The touch of the Initial Range low @ 5370 is a short trade entry with stop loss just above the Initial Range low and target the break of the days low @ 5360.

The test of the days low (Bar 13) and fast resumption of the up move with the break of the downward trend line is a scratch trade. Close the above trade at cost price.

Nifty Future move above the Initial Range high results in a break out failure (Bar 14) and Nifty Future falls below the upward trend line. The attempt to close below the Initial Range low fails (Bar 15) and Nifty Future closes at the Initial Range low

Note:

All the big moves of the day were on Reversal of the overshoot of the trend channel line line i.e. Bar 1, Bar 5, Bar 9, Bar 10, Bar 14. Even though Bears were dominant in todays trading session. Bulls ensured a close above the 61.8% Fibonacci level of Nifty Spot at 5360 and above the previous swing high of Nifty Spot at 5348.

No comments:

Post a Comment